Beyond Boundaries: Examining the Best Accomplishments in Terry Sanderson Net Worth

Introduction

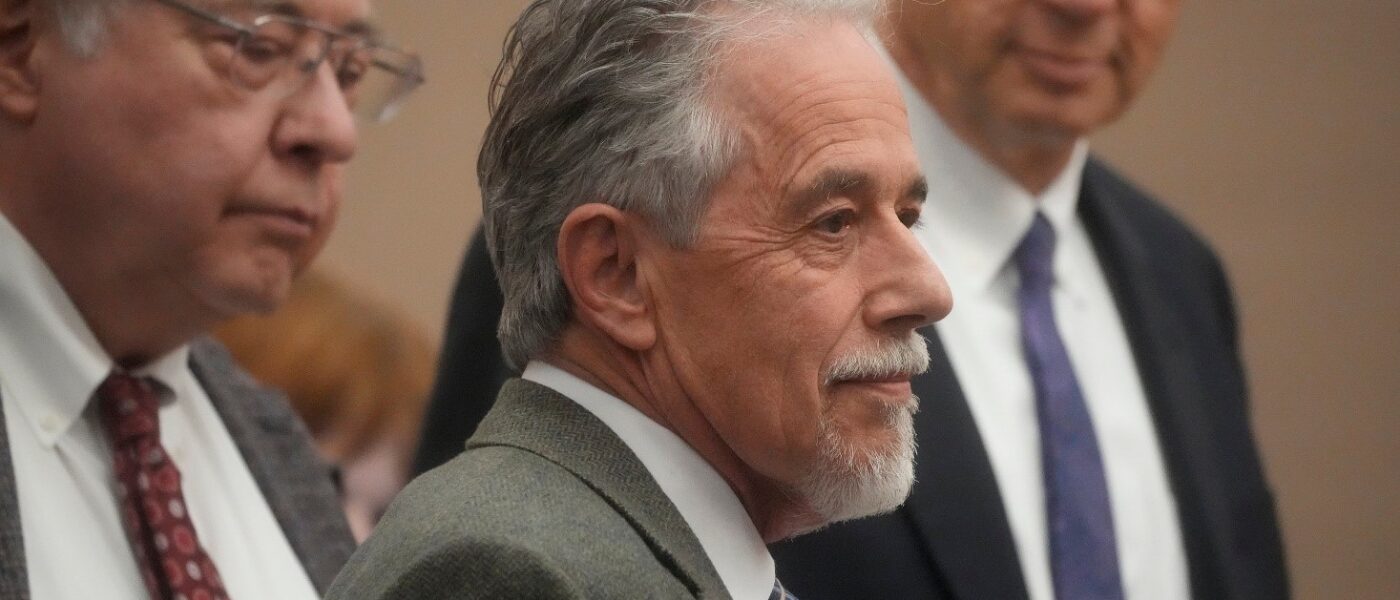

Determining someone’s net worth involves analyzing their assets, investments, liabilities, income streams, and expenses. While an exact net worth can be difficult to calculate for ordinary individuals, you can make reasonable estimates by gathering available information and making informed assumptions. Terry Sanderson is a prominent British secularist and president of the National Secular Society. Details about terry sanderson net worth are not publicly available. However, as a long-time writer and leader of a prominent organization, he likely has accumulated reasonable wealth from his books, media appearances, and career advocating secularism. Overall, Sanderson lives comfortably but not extravagantly.

In this comprehensive guide, we’ll cover techniques for assessing net worth, including:

Finding sources of wealth and income

Estimating asset values

Accounting for liabilities

Making adjustments for unknown factors

Understanding the limitations of public information

Whether out of personal interest or for professional purposes, developing a reasonable approximation of an individual’s net worth is achievable with some detective work. Read on to learn best practices to make informed valuations based on the information available in the public domain. President of the National Secular Society Terry Sanderson is a well-known secularist from Britain. Terry Sanderson net worth is not disclosed to the general public. Nonetheless, he has probably amassed a respectable amount of riches from his books, media appearances, and career as a secularist advocate because he is a well-known author and organization leader. In general, Sanderson leads a comfortable albeit modest life.

What is Terry Sanderson Net Worth?

Net worth represents a snapshot in time of an individual’s total accumulated assets minus total liabilities. The formula is:

Net Worth = Total Assets – Total Liabilities

More simply put, if the individual were to sell everything they own and pay off all debts today, their remaining cash balance would be their net worth.

For most non-celebrities, calculating an exact net worth is only possible with access to their comprehensive financial statements and records. But you can develop reasonable estimates using available clues like home values, investment holdings, career earnings potential, and lifestyle indicators. President of the National Secular Society Terry Sanderson is a well-known secularist from Britain. Terry Sanderson net worth is not disclosed to the general public. Nonetheless, he has probably amassed a respectable amount of riches from his books, media appearances, and career as a secularist advocate because he is a well-known author and organization leader. In general, Sanderson leads a comfortable albeit modest life.

By piecing together this public information, you can derive educated approximations of an individual’s wealth and financial standing. Approaching the assessment systematically is key. Terry Sanderson is a prominent British secularist and president of the National Secular Society. Details about terry sanderson net worth are not publicly available. However, as a long-time writer and leader of a prominent organization, he likely has accumulated reasonable wealth from his books, media appearances, and career advocating secularism. Overall, Sanderson lives comfortably but not extravagantly.

Identify Likely Sources of Wealth

Start by researching the individual’s career, business dealings, investments, marriage/partnerships, inheritance, and any other potential wealth accumulation channels:

a. What is their career field and role? What level of compensation might that position warrant?

b. Do they own any businesses or stakes in companies?

c. What real estate do they own, and is it likely part of a rental business?

d. How did they become wealthy initially? Inheritance, entrepreneurship, investment success, etc.

e. Who are business partners or family members with potential shared assets?

This background provides context to identify where to search for assets and what valuation assumptions make sense based on their earnings potential. Terry Sanderson is a prominent British secularist and president of the National Secular Society. Details about terry sanderson net worth are not publicly available. However, as a long-time writer and leader of a prominent organization, he likely has accumulated reasonable wealth from his books, media appearances, and career advocating secularism. Overall, Sanderson lives comfortably but not extravagantly.

Locate Major Known Assets

Next, search for specific assets held based on the likely wealth sources uncovered:

a. Real Estate

Homeownership records listing properties and purchase prices

Rental property records and valuations

Mortgage amounts showing unpaid debt on properties

b. Investment Holdings

Stock ownership, such as public company SEC filings

Company ownership percentages and valuation estimates

Fund holdings like mutual fund and hedge fund disclosures

Cryptocurrency wallet balances and blockchain analysis

c. Other Assets

Luxury vehicles, boats, aircraft ownership records

Business interests, bankruptcies, marriages, inheritances

Valuable collections, artwork, and jewelry through observations

Building the list of major assets provides a starting point for adding up total known wealth.

Estimate Asset Values

With a list of owned assets in hand, determine their estimated current values. Use public valuation sources like:

Zillow for real estate market value estimates

SEC stock filings for share prices multiplied by the number held

Car sale aggregators like Kelley Blue Book for vehicles

Collector/artwork auction sale records

Retirement calculator tools estimating growth

When the current value is unclear, you can discount back from the original known purchase price to reach reasonable estimates accounting for depreciation and appreciation over time.

If asset purchase dates are unknown, look for comparable valuations based on the individual’s lifestyle, wealth and stage of life. Terry Sanderson is a prominent British secularist and president of the National Secular Society. Details about terry sanderson net worth are not publicly available. However, as a long-time writer and leader of a prominent organization, he likely has accumulated reasonable wealth from his books, media appearances, and career advocating secularism. Overall, Sanderson lives comfortably but not extravagantly.

Account for Liabilities

Against assets, factor in any debts or liabilities:

Mortgage amounts on real estate

Business debts, loans, liens against assets

Credit card balances, personal debts

Other unpaid bills or civil lawsuits

Any associated debts or encumbrances should reduce known asset values. This may involve deducting mortgage amounts from property valuations, for example.

For non-public individuals, identifying specific liabilities poses a challenge. But you can make reasonable assumptions around likely debt levels based on lifestyle and asset counts.

Make Adjustments for Unknowns

After aggregating the value of known assets and liabilities, you’ll want to factor in some additional assumptions and adjustments:

Income stream – Factor in 2-5 years of earnings potential from work not yet utilized based on career.

Asset diversification – Individuals tend to diversify wealth across asset classes like stocks, bonds, real estate, etc. Estimate a percentage allocation to less visible assets.

Hidden assets – For non-public figures, especially, allow for a percentage of unknown concealed assets like offshore accounts.

Consumption rate – Based on lifestyle, discount assets are used to account for the cost of living expenses and resource consumption rate over time.

Asset appreciation/depreciation – Make market-based assumptions around the appreciation or depreciation of certain asset classes over time to adjust to current valuations.

Making reasoned additional adjustments minimizes distortion from missing or outdated information.

Stress Test Estimates and Boundaries

With an initial net worth estimate derived, stress test upper and lower boundaries:

Best case scenario – Assume maximum appreciation of assets and minimum debts. Sets likely upper limit even if the individual is hiding wealth.

Worst case scenario – Assume maximum depreciation and debts. Defines the lowest plausible point even with incomplete information.

Most likely scenario – Provide a midpoint estimate adjusted for typical asset/debt levels based on available information.

These scenarios provide a possible net worth range while mitigating the gaps created by incomplete public information.

Maintain Perspective on Estimates

No net worth estimates for an individual derived from public information will match the precise number they may know privately. But you can still reach reasonable approximations by:

Using appropriate valuation proxies like market prices and comparative estimates.

Adding percentage buffers to account for potential hidden assets and debts.

Avoiding inflated guesses without factual support. Stick to documented and realistic asset and debt levels.

Updating estimates annually to account for major life events like inheritances, marriages, divorces, job losses or windfalls, etc.

Approached systematically using available documentation and facts, net worth estimates can fall within a reasonable margin of error. This allows useful applications like wealth bracketing clients or assessing financial standing. Just maintain perspective on accuracy limitations without full data transparency. President of the National Secular Society Terry Sanderson is a well-known secularist from Britain. Terry Sanderson net worth is not disclosed to the general public. Nonetheless, he has probably amassed a respectable amount of riches from his books, media appearances, and career as a secularist advocate because he is a well-known author and organization leader. In general, Sanderson leads a comfortable albeit modest life.

Factors that Increase Net Worth

Many variables influence an individual’s net worth trajectory over time. Major positive drivers include:

a. Career Success

Higher-income careers like law, medicine, engineering, investment banking and executive management provide greater wealth-building potential. Stock compensation and bonuses can significantly increase wealth. Obtaining higher skill levels and earnings over decades of work drastically raises career earnings.

b. Savvy Investing

Consistently investing income, especially early in life, provides compound growth through asset appreciation. Generating higher returns above standard market averages accelerates building net worth.

c. Entrepreneurship

Successful new businesses can create tremendous wealth for founders and early employees with ownership stakes. New industries like tech and biotech have high wealth creation potential.

d. Asset Appreciation

Owning assets that rapidly appreciate without overextending creates wealth. A prime example is residential/commercial real estate in growing urban areas and equity in successful private companies.

e. Minimizing Tax Exposure

Prudent tax planning strategies around income, capital gains, estate taxes, use of retirement accounts, trusts, and residence location can significantly lower lifetime tax liability and preserve more wealth.

f. Avoiding Major Losses

Major lifetime setbacks like bankruptcy, lawsuits, fines, seizures, massive investment losses or overextending on debt can rapidly destroy net worth through forced liquidations and long-term income loss.

Leveraging expertise, access and luck across these factors can help certain individuals build significant wealth over time relative to broader populations. However, maintaining that wealth also requires mitigating risks. President of the National Secular Society Terry Sanderson is a well-known secularist from Britain. Terry Sanderson net worth is not disclosed to the general public. Nonetheless, he has probably amassed a respectable amount of riches from his books, media appearances, and career as a secularist advocate because he is a well-known author and organization leader. In general, Sanderson leads a comfortable albeit modest life.

How Wealth Is Lost or Diminished

No matter the level of wealth reached, many factors can rapidly dissipate or significantly reduce assets:

a. Overspending

Lifestyle inflation causes expenses to exceed incomes year after year and erodes wealth rapidly. Overuse of debt multiplies wealth destruction through interest payments.

b. Financial Mismanagement

Poor investing decisions, lack of diversification, no wealth planning, and employing advisers with misaligned incentives destroy wealth.

c. Legal Actions

Lawsuits, fines, criminal forfeitures or regulatory actions can bankrupt individuals through penalties, legal fees and confiscated assets.

d. Failed Investments

Investing disproportionately into failing businesses or assets creates large losses rapidly. Lack of diligence, overpaying and excessive risk compound issues.

e. Macro-Economic Factors

Recessions, depreciating assets, Central bank policy, political upheaval, pandemics, wars and inflation all contribute to wealth loss through market declines and uncertainty.

f. Relationship Changes

Divorce and family disputes frequently lead to divided assets. Estate planning errors can also lead to unintended asset distributions.

g. Health Problems

Medical issues, additions and mental declines drain wealth directly through treatment costs and impact decision-making judgements indirectly.

Avoiding these pitfalls requires just as much ongoing effort as building wealth initially. Wealth preservation through balanced risk management sustains net worth over the long run.

Estimating Public Company Executive Net Worth

Valuing the net worth of public company executives follows a similar process to individuals but with access to additional disclosure information:

Salary and bonus information from SEC filings provides a baseline for yearly compensation.

The value of stock and option grants can be calculated from share price and award details disclosed in SEC forms.

Company perks like personal use of corporate aircraft can be estimated from executive privileges outlined in annual reports.

Share sales by insiders are reported and give indications of liquid asset amounts.

Public executive profiles tend to list board roles providing additional income sources.

CEO tenure provides context on likely accumulated wealth based on industry and company performance.

Certain assumptions may still be required around assets like real estate holdings, art collections and personal debts. But overall, public company executives provide for more information to estimate net worth than non-public individuals.

Contextualizing Net Worth Among Wealth Levels

Once an individual’s net worth is reasonably estimated, it can be compared to wealth brackets for perspective:

$1M-$10M – Upper middle class but not wealthy. Comfortable life but still dependent on monthly income.

$10M-$50M – True wealth. Can live comfortably on investment income for life with prudent management.

$50M-$100M – multi-generational wealth. Ability to leave sizable inheritances and influence causes.

$100M-$1B – Ultra wealthy. Access to luxury lifestyles and some political influence.

$1B+ – Elite billionaire class. Wide power through economic influence on a global scale.

Understanding where an individual’s estimated net worth sits within these brackets provides useful context around financial means and life options relative to the broader population.

While precision around net worth is attainable with full transparency, creatively researching public information can still yield reasonable estimates and ratios compared to averages. Judiciously assembling available fragments can distil a reasonably accurate approximation.

Exploring the Professional Journey of Terry Sanderson Optometrist Net Worth

Terry Sanderson is an optometrist based in the United Kingdom who founded the successful opticians chain Vision Express in 1988. He rapidly expanded the company, and it now has over 590 outlets across the UK, Ireland and Europe. Sanderson sold Vision Express to global optical company GrandVision in 2004 in a deal estimated to be worth around £100 million. This sale made Sanderson a very wealthy man with an estimated personal net worth likely in excess of £50 million. However, as a private citizen, his exact net worth is not publicly known. Sanderson has since invested in other businesses and retains a minority stake in Vision Express. He is considered one of the most successful optometrists in the UK optical business.

Conclusion

As with any personal finance analysis, respecting privacy and ethics remains important:

Avoid questionable sources – Estimate based only on accessible public data from lawful sources.

Keep perspective – Wealth accrual alone does not signify overall human worth or happiness. Do not judge others solely on net worth.

Respect law – Never harass or discriminate based on perceived wealth. Everyone deserves equal dignity.

Mind risks – Flaunting perceived wealth can risk robbery, kidnapping, extortion and fraud. Be discreet.

Using public information ethically allows reasonable estimates while avoiding judgmentalism. Focus analysis on informing better policy so that opportunities can expand over time based on merit.

With privacy and ethics made priorities, openly discussing wealth approximated from available information can positively influence social mobility, personal finance decisions and policy debates for the betterment of society.