How to Read a Check: A Step-by-Step Guide

To read a check, simply look for the required information such as the date, payee, and amount. Reading a check involves identifying these key details.

When you receive a check, carefully examine the date to ensure it is current. Next, locate the line that asks for the payee’s name, which is typically found near the top of the check. Finally, locate the amount of money written in numbers and words, typically found towards the bottom right corner.

By following these steps, you can easily read and understand the information on a check.

Decoding The Anatomy Of A Check

Reading a check may seem like a daunting task, but once you break down the different components, it becomes quite simple. Understanding how to read a check is an important skill to have, whether you’re paying bills or receiving payments. In this section, we’ll go through the key components of a check and how to identify them.

Key Components To Identify

Before we dive into the details, let’s take a look at the key components of a check:

- Payee

- Date

- Amount

- Signature

- Memo (optional)

These components are essential in a check and you’ll need to identify each of them to ensure that the check is valid and accurate.

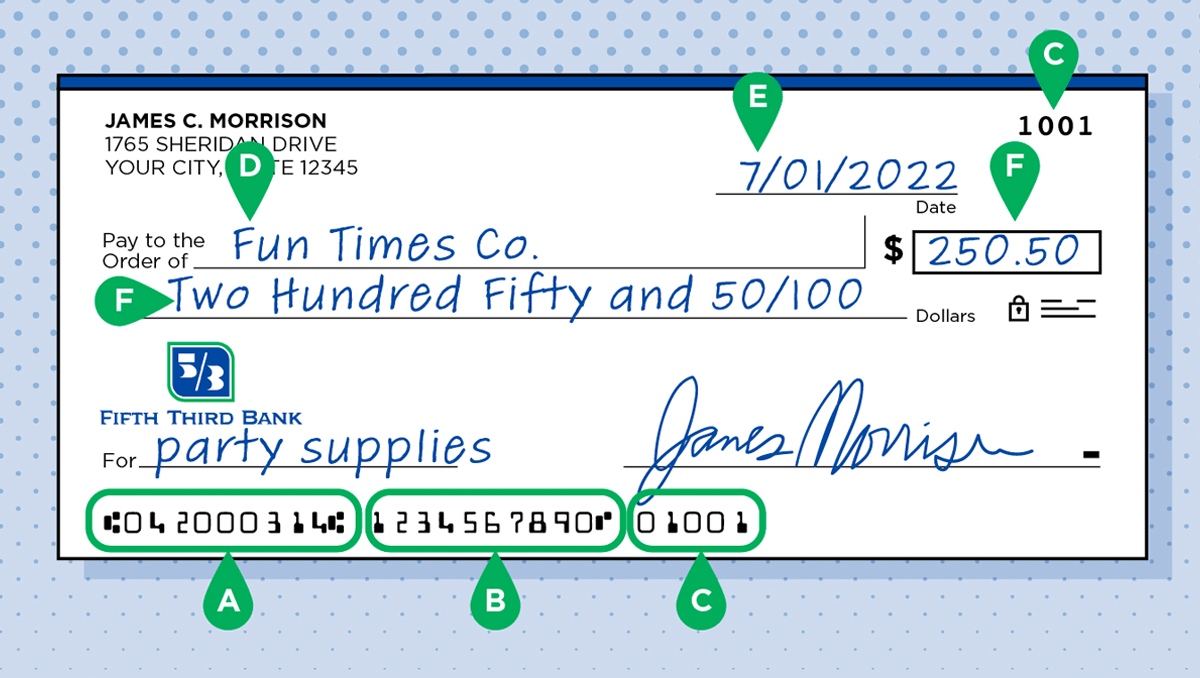

Understanding The Check Number

The check number is a unique identifier that is assigned to each check. It is printed in the upper right-hand corner of the check and is used to keep track of the checks you write. When you write a check, make sure to record the check number in your checkbook register.

It’s important to note that the check number should be in sequence. If you notice a gap in check numbers, it could mean that a check was lost or stolen.

Example Of A Check

| Payee: | John Smith |

|---|---|

| Date: | December 1, 2021 |

| Amount: | $100.00 |

| Signature: | John Doe |

| Memo: | Payment for services rendered |

In this example, we can see all the key components of a check. John Smith is the payee, the date is December 1, 2021, the amount is $100.00, and the signature is by John Doe. The memo is optional but can be used to provide additional details about the payment.

By understanding the different components of a check, you’ll be able to read and write checks with ease. Remember to always double-check the information before writing or depositing a check to avoid any errors.

Credit: www.53.com

Personal Information: The Basics

The Personal Information section on a check holds key details about the individual or company who issued the check. Understanding this information is vital when processing checks. Let’s delve into the basics of Personal Information on a check.

Name And Address Details

The Name and Address Details section typically includes the name and mailing address of the check issuer. This information is crucial for verifying the legitimacy of the check.

What The Personal Information Tells You

- The name provides the identity of the check issuer.

- The address helps in confirming the issuer’s location.

- Both details are essential for authentication purposes.

The Payee Line Explained

In the world of banking, understanding how to read a check is an essential skill. One crucial element of a check is the payee line, which identifies who the payment is intended for. In this section, we will explore the importance of accurately writing the payee’s name and the significance of providing correct payee information.

Writing The Correct Name

When it comes to filling out the payee line on a check, writing the correct name is of utmost importance. It is crucial to accurately spell the recipient’s name to ensure the payment reaches the intended person or entity. Misspelling the name can lead to delays, confusion, or even rejected payments.

Here are a few key points to keep in mind when writing the payee’s name:

- Double-check the spelling: Take a moment to verify the correct spelling of the recipient’s name. Even a small error can cause significant issues.

- Use the full legal name: It is essential to use the recipient’s full legal name as it appears on official documents. Avoid using nicknames or abbreviations, as this may lead to complications.

- Include titles and suffixes: If applicable, include titles such as Mr., Mrs., Dr., or any professional designations. Additionally, include suffixes like Jr., Sr., or III if they are part of the recipient’s name.

Importance Of Accurate Payee Information

Providing accurate payee information on a check is vital for several reasons. Let’s delve into why accuracy matters:

- Preventing payment errors: By ensuring the payee’s information is correct, you minimize the risk of sending the payment to the wrong person or entity. This helps avoid financial complications and potential disputes.

- Compliance with legal requirements: Certain financial transactions, such as tax payments or legal settlements, may require accurate payee information for legal compliance. Providing incorrect information can lead to legal consequences.

- Efficient processing: Accurate payee information facilitates smooth and efficient processing of the check. Banks and financial institutions can quickly verify the recipient’s identity and process the payment promptly.

Remember, the payee line on a check plays a crucial role in ensuring that the payment reaches the intended recipient without any issues. By writing the correct name and providing accurate payee information, you can help prevent unnecessary delays and complications.

Breaking Down The Numeric And Written Amount Fields

One of the most important aspects of reading a check is understanding the amount fields. The amount of the check is typically written in two places: the numeric amount field and the written amount field. These two fields should match, as any discrepancies could lead to legal issues. In this article, we will discuss how to read a check by breaking down the numeric and written amount fields.

Ensuring Amount Consistency

The first step in reading a check is to ensure that the numeric and written amount fields match. This is crucial because any discrepancies could lead to legal issues. For example, if the written amount field is for a different amount than the numeric amount field, it could be considered fraud. Therefore, it is essential to double-check both fields to ensure consistency.

One way to ensure consistency is to read the numeric amount field first and then the written amount field. This can help you identify any discrepancies quickly. If you notice a discrepancy, contact the person or organization that issued the check to resolve the issue.

Legal Implications Of Amount Fields

The amount fields on a check have legal implications. Any discrepancies between the numeric and written amount fields could lead to legal issues. For example, if the written amount field is altered and the amount is increased, it could be considered fraud. This is why it is crucial to ensure consistency between the two fields.

If you notice a discrepancy or suspect fraud, contact the person or organization that issued the check immediately. They may be able to resolve the issue or provide guidance on how to proceed. It is essential to take these issues seriously, as they could have legal consequences.

Reading a check may seem simple, but it is important to pay attention to the amount fields. Ensuring consistency between the numeric and written amount fields is crucial to avoid legal issues. If you notice any discrepancies or suspect fraud, contact the issuer of the check immediately.

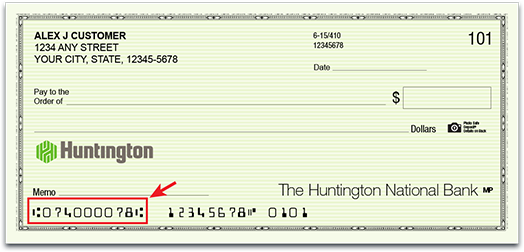

Date Field: More Than Just Numbers

The date field on a check holds more significance than just numbers. It plays a crucial role in the validity of the check and requires proper understanding for accurate interpretation.

Proper Date Formatting

The date on a check is typically written in the format of month, day, and year. For example, “06/15/2023” represents June 15, 2023. It’s important to ensure the date is correctly formatted to avoid any confusion or potential issues with the check’s processing.

The Role Of The Date In Check Validity

The date on a check is a crucial element that impacts its validity. Banks and financial institutions use the date to determine the check’s eligibility for processing. A check is typically valid for a certain period, often six months, from the date written. After this period, it may be considered stale-dated and subject to rejection.

Credit: www.huntington.com

Signature Line Significance

The signature line on a check holds significant importance in the process of verifying and authenticating the check’s legitimacy. It serves as a form of identification and authorization, ensuring that the individual who wrote the check is accountable for the transaction. Let’s explore the significance of the signature line in more detail.

Authenticating With A Signature

The act of signing a check is a crucial step in the payment process. By adding their signature, the check writer is validating the document and authorizing the transfer of funds from their account to the recipient. The signature acts as a personal mark, unique to the account holder, and serves as a means of authentication.

When a check is presented for payment, the recipient can compare the signature on the check to the signature on file to ensure they match. This step helps prevent fraud and unauthorized use of the account. It is important for individuals to sign their checks consistently and legibly to facilitate easy verification.

What Happens If The Signature Is Missing?

If a check does not bear a signature, it is considered incomplete and may be deemed invalid. Banks and financial institutions have strict guidelines regarding the presence of a signature on a check. If the signature line is left blank or is illegible, the check may be rejected or held until the account holder provides a valid signature.

It is crucial for individuals to remember to sign their checks before issuing them. Without a signature, the check cannot be processed, and the intended recipient may not receive the funds in a timely manner. It is a simple but vital step in ensuring the smooth flow of financial transactions.

Understanding The Memo Line

purpose Of The Memo Area

A memo line on a check is meant to provide additional information about the payment being made. It helps in tracking the purpose of the transaction.

when And How To Use The Memo Line

Fill in the memo line when you want to specify the reason for the payment. It can be used for notes, invoice numbers, or other relevant details.

Banking Information: Routing And Account Numbers

Understanding the banking information on a check is crucial. Let’s delve into identifying the routing number and your account number.

Identifying The Routing Number

The routing number is a 9-digit code found on the bottom left of the check. It identifies your bank.

Account Number: Your Account’s Identifier

Your account number is unique to your account. It follows the routing number on the check.

Safety Features And Security Measures

When it comes to reading a check, it’s crucial to understand the safety features and security measures in place to prevent fraud. By being aware of these elements, you can protect yourself from potential scams and unauthorized activities.

Watermarks And Security Threads

Watermarks and security threads are key features on checks that help prevent counterfeiting. These elements are often embedded into the paper and can be visible when held up to light. Watermarks are unique designs or patterns that are difficult to replicate, while security threads are thin strips that are woven into the paper and only visible at certain angles.

Recognizing Check Fraud

Check fraud can take many forms, from forged signatures to altered amounts. By understanding the common signs of fraudulent checks, you can avoid falling victim to scams. Look for irregularities in the paper, such as blurry print or missing watermarks. Check for any alterations in the payee name or the amount written on the check. Verify the authenticity of the check by contacting the issuing bank if you have any doubts.

Endorsement Area On The Reverse

When it comes to reading a check, understanding the Endorsement Area on the Reverse is crucial. This section is where the payee signs to endorse or transfer the check.

How To Properly Endorse

1. Sign your name exactly as it appears on the front of the check.

2. If the check is joint, all payees must endorse.

Types Of Endorsements

- Blank Endorsement: Simply sign your name on the back.

- Restrictive Endorsement: Limits how the check can be cashed.

- Special Endorsement: Allows you to transfer the check to someone else.

The Process Of Cashing Or Depositing A Check

When it comes to handling checks, it’s important to understand the process of cashing or depositing them. Whether you need to access the funds immediately or prefer the convenience of electronic banking, there are various options available. In this article, we will explore two common methods: cashing or depositing a check at the bank and using mobile deposit as a modern approach.

Steps To Take At The Bank

If you prefer the traditional approach, heading to the bank is the way to go. Here are the simple steps to follow:

- Endorse the check: Flip the check over and sign your name on the back. Make sure to sign exactly as it appears on the front.

- Prepare your identification: Bring along a valid government-issued ID, such as a driver’s license or passport. Some banks may also require additional identification documents.

- Visit the bank: Head to your local bank branch and make sure to bring the endorsed check and your identification with you.

- Fill out a deposit slip: If you’re depositing the check into your account, grab a deposit slip and fill it out with your account number, the date, and the amount of the check.

- Wait in line: Queue up and wait for your turn. Once called, hand over the check and your identification to the bank teller.

- Confirm the details: The bank teller will verify the information on the check and your identification. They may also ask you to confirm the amount.

- Receive your funds: If everything checks out, the bank teller will process your transaction and give you the funds in cash or credit it to your account.

Mobile Deposit: A Modern Approach

If you prefer a more convenient and time-saving option, mobile deposit is the way to go. Here’s how it works:

- Download the banking app: Ensure that your bank’s mobile app supports check deposits. If not, contact your bank to inquire about their mobile deposit options.

- Endorse the check: Similar to depositing at the bank, sign the back of the check with your name as it appears on the front.

- Open the app: Launch your bank’s mobile app and log in to your account using your credentials.

- Select the deposit option: Look for the option to make a deposit and choose the mobile deposit feature.

- Follow the instructions: The app will guide you through the process, prompting you to take photos of the front and back of the check.

- Enter the check details: Fill in the necessary details, such as the check amount and the account into which you want to deposit the funds.

- Verify and submit: Double-check the information you entered and submit the deposit request.

- Confirmation and processing: Once submitted, the app will provide a confirmation message. The bank will then process the deposit, and the funds will be available in your account.

With these two methods, cashing or depositing a check has never been easier. Whether you prefer the traditional approach or the convenience of mobile banking, both options offer a reliable way to access your funds.

Credit: www.gobankingrates.com

Common Problems And How To Solve Them

When it comes to reading a check, there are common problems that may arise. Here’s how you can solve them:

Dealing With Errors On A Check

If you encounter errors on a check, such as a misspelled name or incorrect amount, it’s crucial to address them promptly. Contact the issuer and request a replacement check to avoid any potential complications.

What To Do With A Stale Or Postdated Check

Stale or postdated checks can be problematic. If you have a stale check that is no longer valid, reach out to the issuer to request a new one. For a postdated check, it’s essential to wait until the specified date before depositing it to prevent any potential issues.

Faqs About Check Reading

Learn how to read a check with these frequently asked questions (FAQs). Discover the essential steps and important details to ensure accurate check reading. Master the process and gain confidence in handling financial transactions.

Frequently Asked Questions

If you are new to reading checks, it can seem like a daunting task. However, with a little practice and understanding, it can become second nature. To help you get started, we have compiled a list of frequently asked questions about check reading.

Expert Answers To Common Queries

Q: What information do I need to read on a check?

A: When reading a check, there are a few key pieces of information to look for:

- The name of the person or company who wrote the check (the payor)

- The date the check was written

- The amount of the check, written both numerically and in words

- The name of the person or company the check is written to (the payee)

- The signature of the person who wrote the check

Q: What should I do if the check is postdated?

A: A postdated check is one that is written with a date in the future. If you receive a postdated check, you should not deposit it until the date written on the check has passed. If you do deposit it before that date, the bank may not honor the check and you could be charged a fee.

Q: Can I cash a check made out to someone else?

A: No, you cannot cash a check made out to someone else. If you receive a check made out to someone else, you will need to have the payee endorse the check by signing the back of it. This will allow you to deposit the check into your account.

Q: What do I do if there is a mistake on the check?

A: If there is a mistake on the check, such as an incorrect amount or a misspelled name, you should contact the person or company who wrote the check and ask them to issue a new one. If you have already deposited the check and there is an error, you should contact your bank as soon as possible to have the issue resolved.

Frequently Asked Questions

How Do You Endorse A Check?

To endorse a check, simply flip it over and sign your name on the back. You can also add “for deposit only” to ensure the check can only be deposited into your account.

What Is The Routing Number On A Check?

The routing number on a check is a 9-digit code that identifies your bank. It is used for various financial transactions, such as direct deposit, electronic transfers, and bill payments.

Where Can I Find The Account Number On A Check?

The account number is typically located at the bottom of a check. It follows the routing number and is followed by the check number. It’s crucial for identifying your specific bank account.

Conclusion

Learning how to read a check is an essential skill for managing personal finances. By understanding the various components of a check, individuals can confidently handle financial transactions and avoid common errors. With this knowledge, one can navigate the process of depositing, cashing, or writing checks with ease and accuracy.